The world's largest platform for investing in genius people

Our mission

We aim to create a Genius City — a global hub of talent where the future is built. By investing early and owning rights to future inventions, we transform individual potential into trillion-dollar industries.

300M

attracted

investments

432

number of

technologies

Benefits of the

city of geniuses

Security and Resilience

Geopolitical instability makes it critically important to develop a national foundation in science, technology, and human capital.

Physically relocating geniuses to the UAE ensures their safety and protects both physical and intellectual investments.

Uniting efforts around key technologies (water, agriculture, air, greening, plastic recycling, communications, security, analytics, medicine, longevity, and others) makes the country more self-sufficient, resilient, and prepared for future challenges.

National status and reputation as a Technological Hub

The City of Geniuses becomes a powerful social and reputational asset, strengthening the UAE’s global image as a magnet for brilliant minds.

A high concentration of exceptional intellects will enable the creation of a world-class university system in the Emirates — on par with Harvard, Oxford, and Cambridge.

The presence of the City of Geniuses and universities based on it will make the UAE an educational hub for the next generation across the region, instilling values of progress and innovation. Children will no longer need to go abroad for top-tier education.

Accelerating the Creation of the Country of the Future

Artificial intelligence trained on verified genius data will enable early-stage talent identification and the full realization of human potential.

Interaction among geniuses creates powerful synergistic effects, as brilliant minds complement one another, accelerating the development of technology

The concentration of talent, technology, and investment within the City of Geniuses will rapidly advance national ambitions to build a cutting-edge, resilient, and intelligent country of the future.

House of Wisdom or Bayt al-Hikma

(Arabic: بيت الحكمة)

— Let's gather all the smart people in one place so they can drive science forward!

— Let's do it!" said the Caliph of Baghdad in the year 820 — and he did.

Al-Ma'mun sympathized with the Mu'tazilite doctrine, and according to his vision, the House of Wisdom was meant to provide its supporters with a rich body of factual material useful in theological debates — primarily through works on philosophy. Outstanding scholars were brought to Baghdad from all regions of the Caliphate, many of whom were natives of Central Asia and Iran. The House of Wisdom was headed by Sahl ibn Harun.

Startup spending structure is broken

3 FACTS ABOUT INVESTING IN 2025

90% MARKETING

10% TECHNOLOGY

MARKETING

TECHNOLOGY

90% of the investment goes to marketing and only 10% to technology

68% MARKETING

DEPARTMENT

32% TECHNICAL

DEPARTMENTS

MARKETING DEPARTMENTS

TECHNICAL DEPARTMENTS

68% of "tech" companies have 7 times as many people in marketing and sales departments as in technical departments

60% TECHNICAL SPECIALISTS

40% NO TECHNICAL

STAFF

TECHNICAL SPECIALISTS

NO TECHNICAL STAFF

more than 40% of "technology companies" do not have specialized technical specialists on their staff at all

Fake companies can survive for more than 5 years

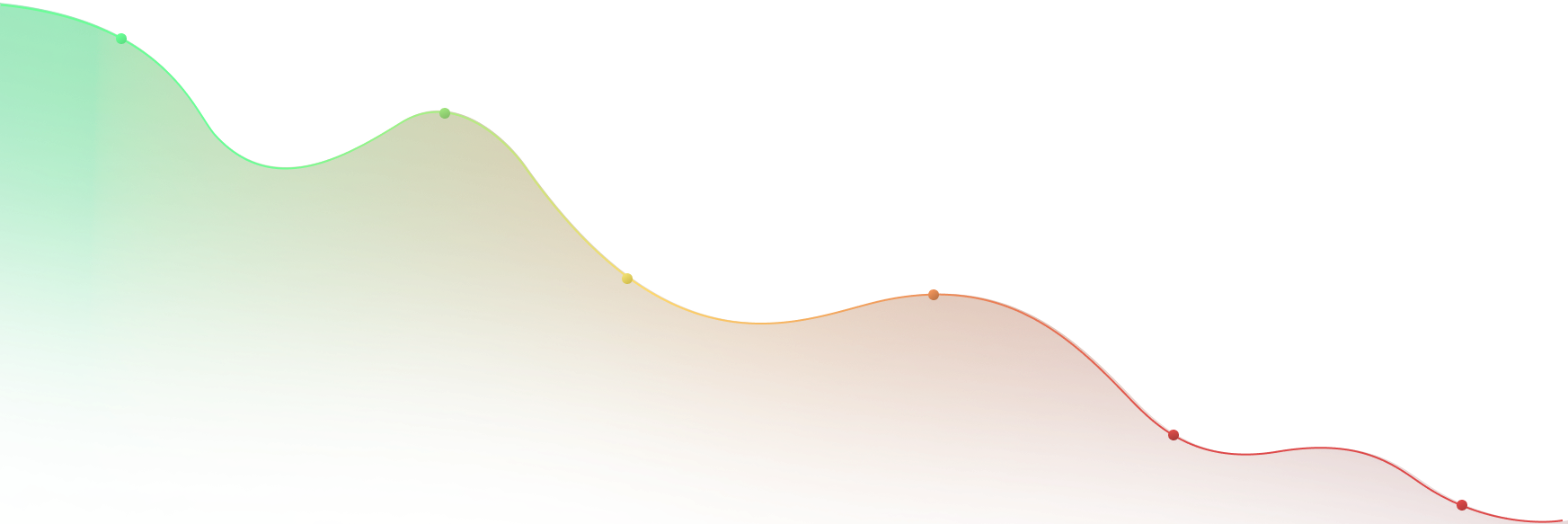

Investment logic is broken

60

50

40

30

20

10

0

The “minute-per-million” metric shows how many minutes an investor is willing to spend getting to know a startup for every million dollars invested.

The “minute-per-million” metric shows how many minutes an investor is willing to spend getting to know a startup for every million dollars invested.

the old mantra «fake it till you make it» is obsolete — it’s now «fake it»

What it leads to

Food that doesn’t fill you

Education that doesn’t teach

Medicines that don’t heal

What it leads to

Psychology that breeds insecurities

Technology that complicates life

Social networks that make people lonely

«When enough people make false promises, words stop meaning anything. Then there are no more answers — only better and better lies»

a Real Future

Medicines that actually cure,

not just mask symptoms

Breakthroughs in science, not pretty

copy and flashy Instagram

New software architectures, not

mindless clones of outdated models

Deep problem understanding, not podcasts

that confuse astronomy with astrology

CONCLUSION

We propose investing in geniuses. After all, human history is the story of great names.

01

A genius simply wants the chance to devote themselves to the object of their passion

02

A genius will never betray their work for the sake of hype or speed.

03

Geniuses cost a fraction of what “star teams” command.

04

One genius can achieve a breakthrough where twenty merely smart people would falter.

Geniuses are:

Concentration of Expertise

One genius holds the deepest understanding of the problem

Capital Efficiency

Funding a genius costs a fraction of supporting a full-scale startup office and large team

Long-Term Systemic Thinking

Geniuses working together can solve challenges that narrow specialists simply can’t

Genius Synergy

A genius plans decades ahead, driving fundamental breakthroughs

Holistic Solutions

A genius focuses on solving the entire problem, not just offering a “painkiller subscription

Minimized Operational “Noise”

A genius needs only themselves, an assistant, quiet and peace—and no worries about a roof over their head

Talent Magnet

One genius attracts other top-tier experts, building an ecosystem of brilliance

Sustainable IP Moat

A genius’s work is backed by patents and unique methods, not easily replicated

While startup:

Shallow Expertise

Startups rarely cultivate deep knowledge, prioritizing speed and surface-level skills

Budget Waste

Huge amounts go to marketing and operations, not to real research or invention

Noisy Culture

Hackathons, networking, and pitch events distract from real problem-solving

Short-Term Thinking

Success is measured by funding rounds, not long-term breakthroughs

Closed to Knowledge

Fight fiercely for funding and hoard their methods, never sharing knowledge or best practices

Painkiller Subscription

Aim to sell a “painkiller subscription”, not to eradicate the underlying problem

Stars Replaced Experts

Recruit loud “star hires” who often displace deep specialists

Rounds Instead of Mission

Success is measured by funding rounds, not long-term breakthroughs

Why it will be work with us

Powerful technology

We possess one of the most advanced personalized human-understanding technologies, enabling us to identify geniuses more accurately, support their growth, and unlock their potential—critical, since geniuses are often sensitive and complex individuals

Interested investors

We have a broad community of impact investors who understand the value of contributing to the future and backing long-term projects instead of chasing short-lived hype

Extensive connections

We maintain extensive connections across the global science and innovation ecosystem, so sourcing and relocating geniuses will pose no challenge

genius city clusters

Genius City 1

Critical infrastructure and essential technologies: water desalination, food security, low-cost automated farming, energy, greening and oxygen enrichment, development of advanced materials, and communications.

Critical infrastructure and essential technologies: water desalination, food security, low-cost automated farming, energy, greening and oxygen enrichment, development of advanced materials, and communications.

Genius City 2

Medicine & longevity: drug development, pharmaceuticals, regenerative medicine, new treatment methods, and practitioners with unique hands-on medical expertise across various specialties.

Medicine & longevity: drug development, pharmaceuticals, regenerative medicine, new treatment methods, and practitioners with unique hands-on medical expertise across various specialties.

Genius City 3

Artificial intelligence: neural-network development, AI safety, and data governance.

Artificial intelligence: neural-network development, AI safety, and data governance.

Genius City 4

Materials & ecology: plastic decomposition, construction innovations, and waste recycling.

Materials & ecology: plastic decomposition, construction innovations, and waste recycling.

Genius City 5

Education & human capital development: innovations in school education, modernization, personalization, and digital learning.

Education & human capital development: innovations in school education, modernization, personalization, and digital learning.

Genius City 6

Advanced general-purpose technologies: weather and climate control systems, and autonomous transportation.

Advanced general-purpose technologies: weather and climate control systems, and autonomous transportation.

Find out which technologies are already being developed

432

number of

technologies

Why investors will invest in the City of Geniuses

What the investor gets, beyond profit

What the investor gets, beyond profit

First right of implementation

on any technology developed in Genius City

Exclusive seat on the strategic council

with the power to shape the R&D agenda and set research priorities

Priority pre-emptive rights

to invest in early-stage startups at deeply discounted terms

First pick of top genius talent

with priority recruitment for your own projects or corporate R&D hubs

Unlimited personal access

to all breakthrough technologies, products, therapies, and procedures

Potential special legal incentives

such as preferential tax treatment and streamlined regulatory approvals

What we search from investors

Our mission

We aim to create a Genius City — a global hub of talent where the future is built. By investing early and owning rights to future inventions, we transform individual potential into trillion-dollar industries.

Investments in each Genius City cluster (6 clusters in total) of $50 M–$100 M

Land for the construction of the Genius City clusters

A government support program for geniuses and major investors in Genius City and established contacts and partnerships with government bodies and lcorporations

Our mission

We aim to create a Genius City — a global hub of talent where the future is built. By investing early and owning rights to future inventions, we transform individual potential into trillion-dollar industries.

Facts about giniuses

There are over 200 types of genius, and conventional methods of recognition and measurement simply don’t work.

There are over 200 types of genius, and conventional methods of recognition and measurement simply don’t work.

They are not adapted to everyday life

They are not motivated by money or fame, but by the idea

Without support, 49,999 out of 50,000 geniuses will never fulfill their potential

Investing in Einstein

at an early stage would have given control over the development of nuclear energy

Investing in Alexander Fleming

would have granted control over the pharmaceutical industry worth trillions of dollars

How Much is the

second Einstein Worth?

A single genius can reshape entire industries and unlock trillions in value. Investing early in undiscovered talent offers returns greater than any venture investment today.

$500 000

Equivalent to a $2,500 -

$3,000/month salary

over 15-20 years

50 000

Geniuses have the

potential to change

the world

25B

Total investment

required

How it works?

We identify genius individuals

using our comprehensive methodology, AI scoring, and live interviews

We relocate them to the Emirates

and place them in the appropriate cluster within Genius City

We've been funding them for 15 years

providing them with comfortable accommodation, food, medicine and working conditions

Geniuses work in their field

enrich our IP bank, and unlock various monetization opportunities

Revenue streams

We offer multiple avenues to monetize our IP and technologies, ensuring sustainable revenue and scalability

Real-World Examples of IP Revenue

Why the City of Geniuses must be physical and located in the Emirates

Scroll to discoverWhat we can bring if granted Citizenship/Passports

We can relocate 100–500 millionaires with personal capital of at least $20 M, along with their families and children, to the Emirates.

We can bring and pre-invest up to $1.5 billion of capital into the region

We can transfer entire high-tech business operations—longevity clinics, engineering centers, and more

We can introduce 2,000–5,000 competent C-level executives and managers, along with their families and collective experience

Let's build a new society together and help develop geniality

$500 000

equivalent to a $2,500 -

$3,000/month salary

over 15-20 years

50 000

geniuses have the

potential to change

the world

25B

total investment

required